|

|

Stocks Drop, Rates Rise, Home Sales Strengthen

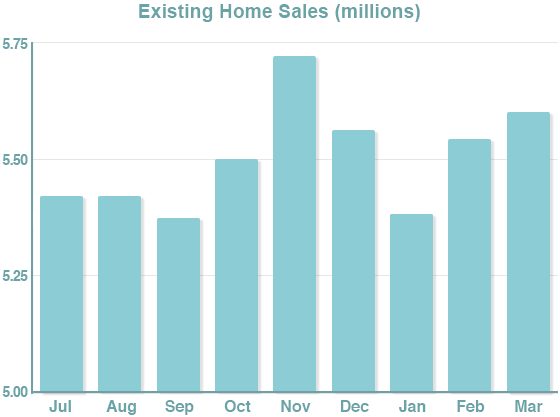

Overview: The stock market dropped sharply over the past week. Normally, this would result in investors shifting assets to bonds, and the added demand would push yields lower. However, that was not the case this week, and mortgage rates ended at the highest levels in four years. This week’s two reports on home sales were both stronger than expected, but sales of new homes were the clear winner. In March, sales of previously owned homes increased 1% from February to an annual rate of 5.6 million units, but they still were a little lower than a year ago. Sales of newly built homes were up a stronger 4% from February to an annual rate of 694,000 units, 9% higher than they were a year ago. A look at the number of homes on the market likely explains the better performance for new homes. The inventory of previously owned homes for sale was at just a 3.6-month supply, and it was 7% lower than a year ago. By contrast, there was a 5.2-month supply of new homes on the market, and the level was 13% higher than a year ago. The median price of both previously owned and new homes was roughly 5% higher than a year ago. Week Ahead

|

|

Contact us to discuss how we can help your clients with their mortgage needs.

|

Equal Housing Lender | © 2024 Schmidt Mortgage Company / Click n’ Close Inc.

Equal Housing Lender | © 2024 Schmidt Mortgage Company / Click n’ Close Inc.